Information for Financial Planners

Do you know how to interpret the Canada Pension Plan Statement of Contributions?

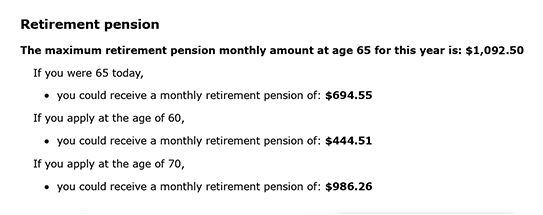

The My Service Canada website lets contributors view estimates of their monthly Canada Pension Plan (CPP) retirement benefits at 60, 65, and 70. (To see the estimates, a user must register and then log in. After logging in, the information is available via links on the My Service Canada Account page. The screenshot below shows a sample of part of the Estimated Monthly CPP Benefits page.)

The estimates for CPP retirement pensions starting at age 60, 65 and 70 are calculated as though your client has reached each of those ages on the date that the Statement of Contributions (SOC) was created. In effect, the estimates assume that the "average lifetime earnings" that your client has had from age 18 until the last year shown on the SOC will continue until ages 60, 65, or 70. In fact, your client's future earnings may be quite different.

If your client is still working and earning at or above the amount of the Year's Maximum Pensionable Earnings (YMPE), their calculated CPP retirement pension could increase from the amount shown on the SOC by as much as approximately $28 per month for each year of additional earnings. (It may also not change at all.)

If your client is still working but earning less than the YMPE, their calculated CPP retirement pension could actually decrease from the amount shown on the SOC with each year of additional earnings and contributions.

If your client is no longer working, their calculated CPP retirement pension could decrease from the amount shown on the SOC by as much as approximately $28 per month for each year of additional zero earnings. (It also may not change at all.)

If your client is currently over the age of 60 and has enough years of earnings at or above the YMPE, additional CPP contributions may not increase their regular CPP retirement pension. However, the contributions could create eligibility for post-retirement benefits if your client applies for their CPP retirement pension early.

If your client was ever the primary caregiver for a child under the age of seven, they may be able to claim the CPP child-rearing provision, and their actual CPP retirement pension may be significantly higher than the amount shown on the SOC.

DR Pensions Consulting specializes in providing accurate CPP retirement pension calculations based on your client's actual age and using any future earnings scenario(s) they want to investigate. We can also determine the impact of the child-rearing provision on a retirement pension calculation. Contact us today for accurate information.